I’ve listened to quite a few retailers over the years talk about how their customers just don’t need financing, or so they think. Therefore, they tend not to promote consumer financing or discuss it with their customers during the shopping process.

With the exception of a few high-end retailers, most retailers have a fairly high percentage of consumers walking through their doors that have less than great credit and/or not much available credit (“purchasing power”) to use on a purchase in the store.

By not promoting and discussing financing, including near-prime credit and no-credit-check financing, the retailer has inherently shrunk its potential target customer base to those that have the means AND desire to purchase on their existing credit lines or with cash. You see, just because an individual has an available balance on their credit card of, say $3,000, doesn’t mean they want to use all or most of it on a furniture, jewelry, appliance, or bedding purchase today.

Consumers tend to view their credit card as that primary money source to be used for essential or “staple” purchases (e.g., gas, groceries, clothing, etc.) or for emergencies, such as medical or dental, automotive repair, or some other unexpected expense.

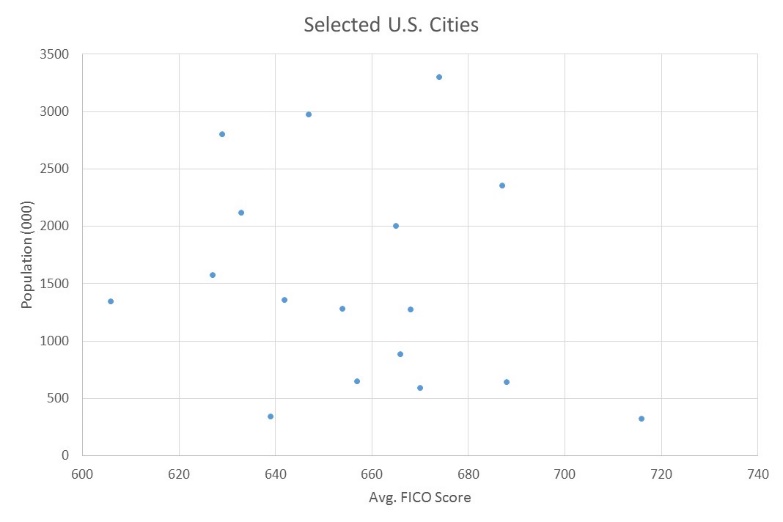

You would be very surprised how low the average FICO score is in your town or city.

A few examples include:

- Milwaukee, WI – 627

- Louisville, KN – 654

- Wichita, KS – 657

- San Diego, CA – 674

- Memphis, TN – 606

- Albany, NY - 666

- Tampa, FL – 647

- Las Vegas - 639

See the following chart for a more detailed breakdown.

The fact is nearly 100 million Americans have less-than-prime credit. But, many retailers look at this pool of people and say, “That’s not my customer!” I say, “That’s a lot of potential customers!” If you had the right consumer finance program in place, and if you promoted and discussed it with your customer, you undoubtedly would see an immediate increase in sales, made possible by putting new purchasing power in the hands of your customers.

By assuming your customers don’t want or need financing and only discussing consumer financing if someone asks about it is short-changing your sales potential. Most consumers will only want to, or be able to, finance a certain amount of goods.

So, why give the store down the street who promotes financing options the sale?